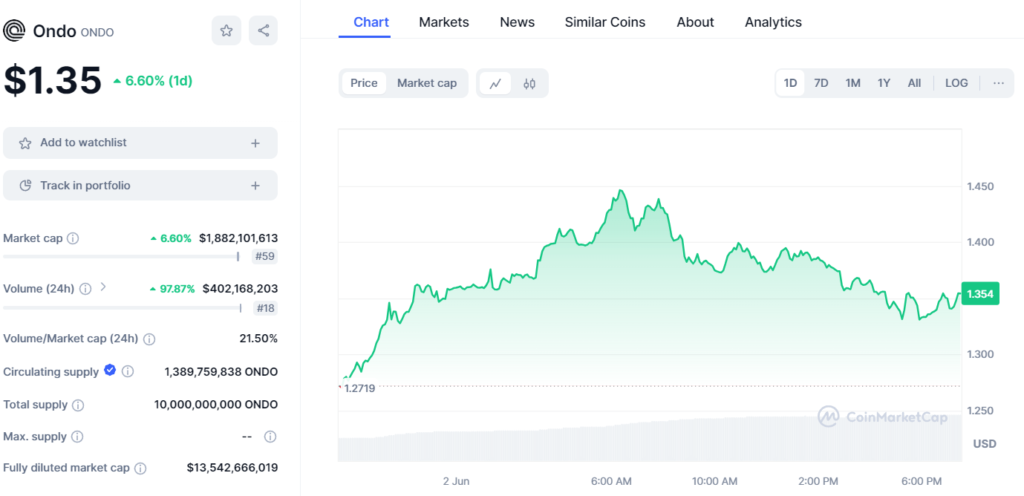

Among the existing cryptocurrencies of the market, a particular focus has been drawn on thesince its 6 daily average rise. 60%, and increases the stock price from $0. 95 to $1. 35. Such an increase has brought the market capitalization to a figure of about $ 1. 88 billion, which in turn moves this cryptocurrency to the 59th position in the market cap ranking.

Interestingly, the trading volume of ONDO, significantly increased by 97 percent. over 78% within the same 24-hour period; popular stocks traded during the period aggregated to around $402 million. This increase in volume helps to explain why investor activity appears to be picking up, a fact supported by the ratio of the total daily volume to the market capitalization, which sits at 21. 50%.

This key ratio depicting the intensity of operation is a cause of concern as it indicates that ONDO’s overall market value is highly active, something that can be regarded as a mixed blessing. Besides, they can results in higher probability, enabling easy entry or exit in the market but are characterized by high volatility. Investors should be cautious because, as it can be seen, such fluctuation’s high chances are that prices will shift either upwards or downwards, and this may not be beneficial to investors in the way they wish to trade.

According to the market capitalization, the circulating supply of ONDO is 1. 389 billion tokens in circulation which is only a small percentage out of the total supply of tokens that will ever be in existence with a cap of 10 billion tokens. Again, this means that there are a lot of tokens that can be released into the market, which could create a problem of dilution of the coins and a reduction in the price or provide an opportunity for future growth if well stumbled on.

There are the following probable factors as to why Ondo’s recent performance could be as such. The upward or downward movements in ONDO price may be attributed to events occurring within the system or on behalf of the ONDO ecosystem, or changes in ONDO’s relationship with other firms, or any other favourable news that would likely improve ONDO. Furthermore, there might be factors such as the overall feeling regarding the crypto market or even the state of macroeconomics.

It also emphasises that investments made in currencies such as ONDO must be in light of the activities that determine its activity in the market as well as the specific constraints that apply to the asset. Looking at the volatility of trading volume and market capitalization points to the fact that the crypto markets are fairly responsive to constructs in and outside of the crypto sphere. These conditions make the markets volatile and therefore any potential investor should enter the market prepared to deal with such fluctuations.

To sum up, when deciding to ONDO as an investment option, while increased price and traded volume may attract speculators it is crucial to consider the element of the risk related to ONDO’s supply and especially future supply releases. Sophisticated investors are also expected to take into account these characteristics, assess the possibilities of the long-term evolution of the ONDO ecosystem, as well as given market conditions that may impact its sustainability and further increase.