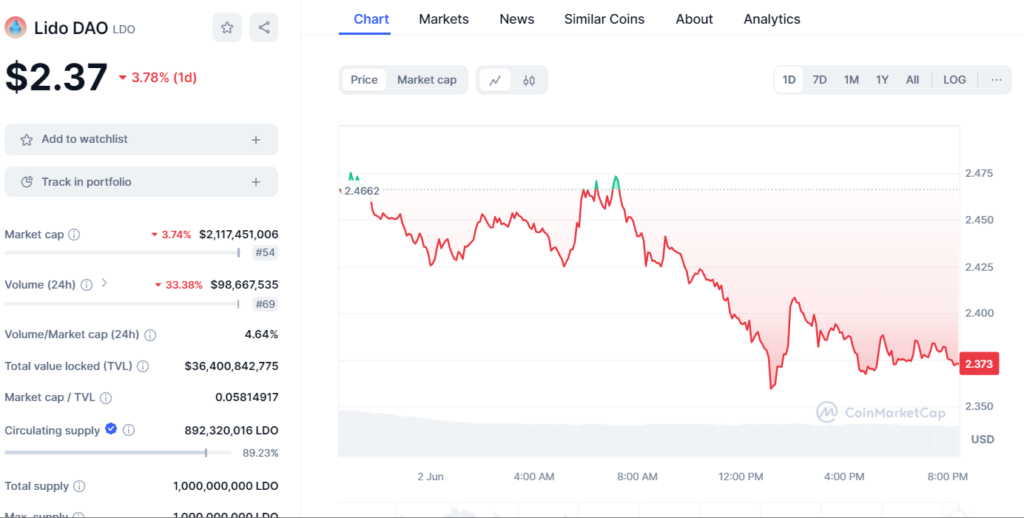

With its sights set on the trends of DeFi that have continued to develop, LidoDAO has turned out to be an important player, particularly revealing some rather high volatility in terms of the market. Going by the current flow that may allow for the last digits to change, we have Lido DAO at $2. Out of the sampled individuals who use social media thirty-seven admitted to reduced usage by an average of 3. The infection rate per 100 thousand population of the territory where the patient was a resident, within the past day was 74%. They have, however, shown a little decline in the recent period that enables us to examine the trend that provides a general indication about the current stance of mercury within the market and its potentiality in the future.

Lido DAO has declined to be valued at 3% of its total market value Lido DAO is currently occupying the 28th position and has a total Market Capitalization of $203,874,936. 93% to approximately $2. PRG is currently ranked the 54th largest cryptocurrency with respect to market capital with those standing at around 12 billion US dollars. More generally, its findings indicate negative trends in total market capitalization, coupled with an increase of 34% in trading volume. 05% to $98. Also, based on current figures, there are more than sixty-seven million users who may be active within the same twenty-four hours. This is usually witnessed when there is a large volume and price decline of the underlying assets; this may probably mean more efficiency and effectiveness in the liquidation processes of investors, meaning that the former may be opening new positions at possibly low prices or closing existing positions they probably held earlier.

DeFi project in this context focuses on the merger of both Defiance and Ethereum and, for projects such as Lido DAO, the guiding value of higher measure of TVL stands at $36. 40 billion. This is also crucial for TVL as it demonstrates the amount of crypto assets locked in the protocol for staking for example, which enables DeFi platforms to prove their relevance and usefulness. Therefore, the presence of more than $278 should be further assessed. currently occupies the 35B maker position in the Defi market, and taking into account the rate of participation and capital investments, it is possible to conclude that Lido DAO can be regarded as the key player in the Defi market. Also, using the analysis of composite display 4, the results shown by the average Market cap to TVL ratio of this is 0. Returns for the public shareholders involved in the project seem to be described in item 058, where the company market value might be far below the total asset value of the project.

The primary purpose of Lido DAO is to provide liquidity for staked assets which is quite useful for staking participants to a certain extent and helps them not get fully locked inside the staking application. This mechanism gains much relevance due to the fact that it enhances the technical viability and flexibility of staking in Ethereum and other blockchains; the expansion of the demand and recognition of the Lido DAO can be achieved especially if novel opportunities in the staking market continue to emerge.

However, with regard to the cryptocurrency market and especially the DeFi sector, high volatility and increased responsiveness to tendencies in the industry, changes in the regulatory environment, and the development of new technologies are quite common. The activity that happens in the LDO asset might be influenced by changes within the cryptocurrency trading market and outlook or general factors in the Lido DAO environment. This therefore means that investors should exercise a lot of care bearing in mind that the turnover is relatively high and vulnerable to change – thus being a very likely negative way.

Potential investors or current stakeholders of Lido DAO should keep an eye on several factors: factors like fluctuating markets, new markets appearing in the DeFi market, changes in the staking, and even more. They are the events that matter for DeFi projects since they can cause more attention: the project’s business model is seen as valid and legal, or new challenges emerge that hinder the project’s work and growth.

In conclusion therefore, while it is seemingly true that Lido DAO possesses the potential of becoming prominent in the future given the solutions implemented in the sphere of DeFi as well as the high total value locked, the current instability that is evident in the market as well as the risks envisaged in the sphere of DeFi cannot be looked down upon. An investor should consider some options and then determine how to proceed in the DeFi market knowing its risks and the key aspect for growth. Based on the dynamics of stake distribution, evaluating how Lido DAO has responded to the shifts in the market environment and whether it is possible for decentralized pools to maintain their success in the long term, one could presume the sustainable success, and prosperity in decentralized pools.